Following are the merchandising transactions of dollar store, a topic that has garnered considerable attention in the business realm. This discourse delves into the intricacies of merchandising transactions, exploring their types, accounting practices, inventory management techniques, and financial analysis methods.

Prepare to embark on an enlightening journey that will equip you with a comprehensive understanding of this fundamental aspect of merchandising businesses.

Merchandising transactions play a pivotal role in the success of any retail enterprise. Understanding their nuances is essential for businesses seeking to optimize their profitability and financial performance. This Artikel serves as a valuable resource, providing a structured framework for comprehending the complexities of merchandising transactions.

Types of Merchandising Transactions

Merchandising transactions involve the purchase and sale of goods for the purpose of generating profit. Common types of merchandising transactions include:

- Purchase of merchandise:The acquisition of goods from suppliers.

- Sale of merchandise:The transfer of goods to customers for a price.

- Return of merchandise:The return of goods to the supplier by the customer.

- Allowance for damaged merchandise:A reduction in the price of goods due to damage or defects.

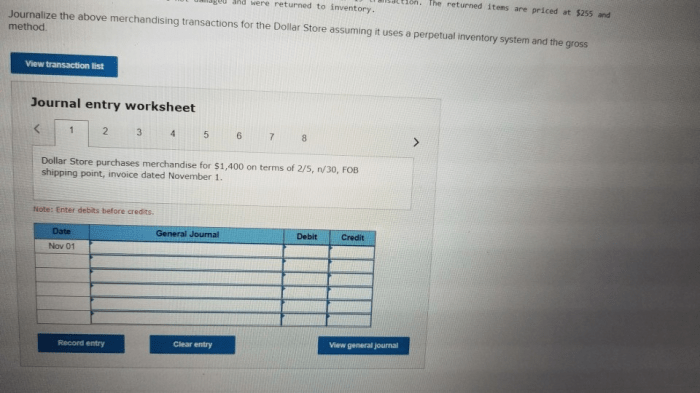

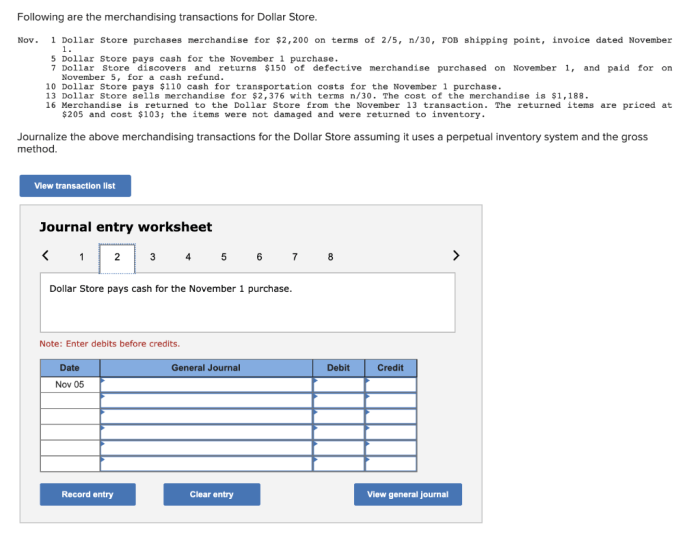

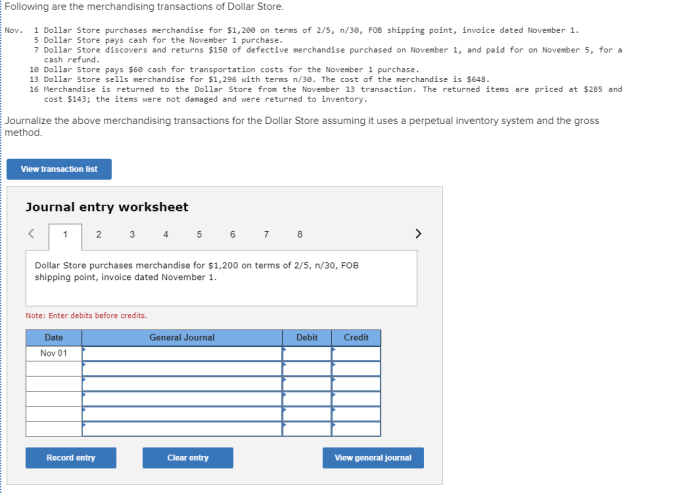

Accounting for Merchandising Transactions

Merchandising transactions are recorded in the accounting system using the following accounts:

- Merchandise inventory:The account that tracks the cost of goods available for sale.

- Sales:The account that tracks the revenue generated from the sale of goods.

- Purchases:The account that tracks the cost of goods purchased from suppliers.

- Returns and allowances:The account that tracks the reduction in revenue due to returns and allowances.

The following is an example of how to account for a merchandising transaction:

Purchase of merchandise: Debit Merchandise Inventory, Credit Accounts Payable

Inventory Management

Inventory management is crucial for merchandising businesses as it helps ensure that the business has the right amount of inventory to meet customer demand without overstocking or understocking. Common inventory management methods include:

- First-in, first-out (FIFO):Assumes that the first goods purchased are the first goods sold.

- Last-in, first-out (LIFO):Assumes that the last goods purchased are the first goods sold.

- Weighted average:Calculates the average cost of goods sold based on the cost of all goods available for sale during the period.

Inventory turnover and days’ sales in inventory are important metrics used to evaluate inventory management:

- Inventory turnover:Measures how quickly inventory is sold and replaced.

- Days’ sales in inventory:Indicates the average number of days it takes to sell the inventory on hand.

Gross Profit and Net Income: Following Are The Merchandising Transactions Of Dollar Store

Gross profit is the difference between the revenue generated from the sale of goods and the cost of goods sold. Net income is the difference between gross profit and operating expenses.

Gross profit is calculated as:

Gross Profit = Sales

Cost of Goods Sold

Net income is calculated as:

Net Income = Gross Profit

Operating Expenses

Financial Analysis

Financial ratios can be used to analyze the financial health of merchandising businesses. Common financial ratios include:

- Gross profit margin:Measures the percentage of sales revenue that is generated as gross profit.

- Net profit margin:Measures the percentage of sales revenue that is generated as net income.

- Inventory turnover:Measures how quickly inventory is sold and replaced.

- Days’ sales in inventory:Indicates the average number of days it takes to sell the inventory on hand.

Financial ratios can be used to identify trends, compare performance to industry benchmarks, and make informed decisions about the business.

Essential Questionnaire

What are the different types of merchandising transactions?

Merchandising transactions encompass various types, including purchases, sales, returns, and allowances. Each transaction involves the exchange of goods or services between a buyer and a seller.

How are merchandising transactions recorded in the accounting system?

Merchandising transactions are recorded in the accounting system using specific accounts, such as Inventory, Sales, Purchases, and Cost of Goods Sold. These accounts track the flow of goods and the associated costs and revenues.

Why is inventory management important for merchandising businesses?

Inventory management is crucial for merchandising businesses as it ensures the availability of products to meet customer demand while minimizing the risk of overstocking or stockouts. Effective inventory management helps optimize cash flow and profitability.