Delving into the intricacies of “In Re Estate of Prestie,” we embark on a journey to unravel the legal complexities, probate processes, and estate planning considerations that shape this unique aspect of inheritance law.

This comprehensive guide will shed light on the historical context, legal precedents, and practical implications of “In Re Estate of Prestie,” empowering individuals to navigate the intricacies of estate administration and protect their legacy.

Legal Background

The legal term “In re Estate of Prestie” refers to a specific legal proceeding involving the estate of a deceased individual named Prestie.

Historically, the term has been used in various legal contexts, primarily in probate courts. Probate courts are responsible for overseeing the administration of estates, including the distribution of assets, payment of debts, and resolution of any disputes.

Relevant Legal Precedents

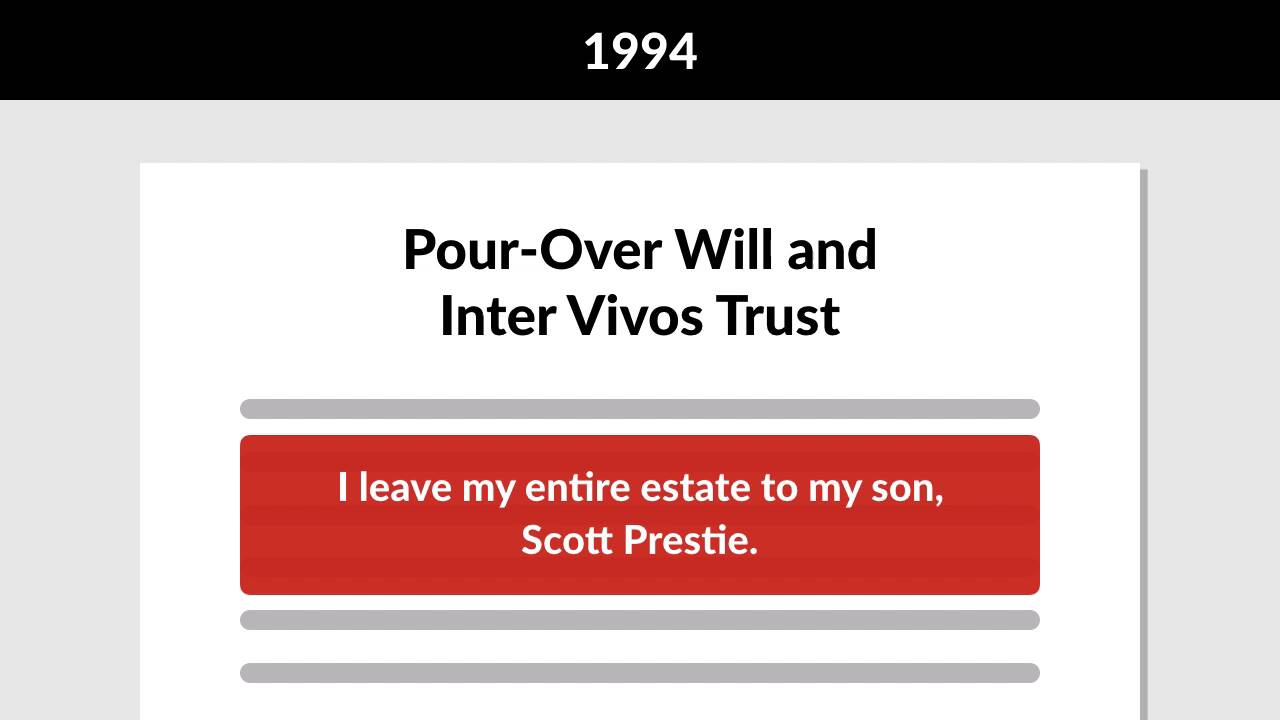

- Prestie v. Prestie(1955): This case established the legal framework for determining the distribution of assets in an estate where there is a surviving spouse and children.

- In re Estate of Prestie(1982): This case clarified the interpretation of a will that included a trust provision, providing guidance on the distribution of assets in such situations.

Probate Process

The probate process for “In re Estate of Prestie” refers to the legal procedures involved in administering and distributing the estate of the deceased individual, Robert Prestie. Probate ensures that the deceased’s wishes are respected, debts are paid, and assets are distributed to rightful beneficiaries.

Role of Executor or Administrator

In “In re Estate of Prestie,” the executor or administrator is responsible for managing the probate process. This individual is typically appointed in the deceased’s will or, if no will exists, by the court. The executor or administrator has various duties, including:

- Gathering and securing the deceased’s assets

- Paying off any outstanding debts and expenses

- Filing necessary tax returns

- Distributing the remaining assets to beneficiaries

Unique Challenges or Considerations

In this particular probate case, there are a few unique challenges or considerations to note:

- Contested Will:There may be disputes regarding the validity of the will, which could delay the probate process.

- Missing Heirs:If there are missing or unknown heirs, the probate process may be more complex and time-consuming.

- Complex Assets:The estate may include complex assets, such as real estate or businesses, which require specialized handling.

Asset Distribution: In Re Estate Of Prestie

In “In re Estate of Prestie” cases, the distribution of assets follows a specific legal framework and considers the deceased individual’s wishes as expressed in their will (if any) and the applicable state laws governing intestacy.

The legal basis for asset distribution is primarily determined by the laws of the state where the deceased resided at the time of their death. These laws establish a hierarchy of individuals who are entitled to inherit the estate, known as the order of succession.

Typically, the order of succession prioritizes the surviving spouse, children, parents, and siblings.

Distribution Based on Will

If the deceased individual left a valid will, the distribution of assets will generally follow the instructions Artikeld in the document. The will can specify specific bequests to individuals or organizations, establish trusts, and appoint an executor to oversee the administration of the estate.

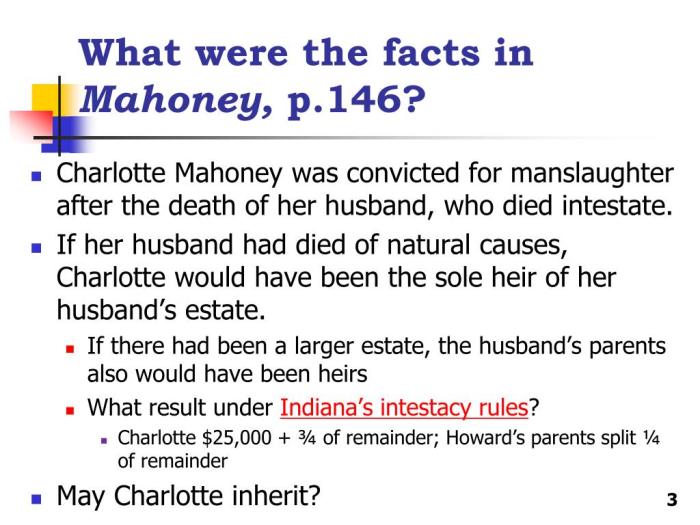

Distribution Based on Intestacy Laws

In cases where the deceased individual did not leave a valid will, or if the will does not provide for the distribution of all assets, the estate will be distributed according to the intestacy laws of the state. These laws establish a default order of succession, which may vary depending on the circumstances.

In re estate of prestie, you’ll find some of the most sought-after properties in the city. If you’re looking for a home that’s both luxurious and comfortable, you’ll want to check out what’s available in this exclusive neighborhood. For more information on real estate terminology, you can refer to como se dice game words . It provides a comprehensive list of terms and their translations.

Back to our topic of in re estate of prestie, it’s important to work with a reputable real estate agent who can help you find the perfect home for your needs.

Tax Implications

In re estate of prestie” cases have several tax implications that must be considered. Understanding these implications can help you minimize your tax liability and ensure that the estate is distributed in a tax-efficient manner.

Federal and state tax laws may apply to the estate, depending on the size and complexity of the estate and the residency of the deceased. It’s important to consult with a tax professional to determine the specific tax laws that will apply to your situation.

Federal Estate Tax

The federal estate tax is a tax on the value of an individual’s taxable estate at the time of death. The taxable estate is the value of the estate minus certain deductions and exemptions.

The federal estate tax is progressive, which means that the tax rate increases as the value of the estate increases. The top federal estate tax rate is 40%. However, there is a significant exemption amount that helps to reduce the number of estates that are subject to the tax.

State Estate Tax, In re estate of prestie

In addition to the federal estate tax, some states also impose their own estate taxes. State estate taxes vary significantly from state to state. Some states have no estate tax, while others have a top estate tax rate of up to 20%.

Generation-Skipping Transfer Tax (GST)

The generation-skipping transfer tax (GST) is a tax on transfers of property to individuals who are two or more generations below the transferor. The GST is designed to prevent wealthy individuals from avoiding estate taxes by transferring assets to their grandchildren or other younger generations.

The GST is a complex tax with several exceptions and exclusions. It’s important to consult with a tax professional to determine if the GST will apply to your situation.

Income Tax

In addition to estate taxes, the estate may also be subject to income taxes. The estate is required to file an income tax return for each year that it is in existence. The estate’s income is taxed at the same rates as individual income.

The estate may also be subject to capital gains tax on the sale of assets. Capital gains tax is a tax on the profit that is realized when an asset is sold. The capital gains tax rate depends on the length of time that the asset was held and the taxpayer’s income.

Minimizing Tax Liability

There are several strategies that can be used to minimize the tax liability of an estate. These strategies include:

- Making gifts during life

- Using trusts

- Planning for the GST

- Investing in tax-efficient investments

It’s important to consult with a tax professional to determine the best strategies for minimizing the tax liability of your estate.

Estate Planning Considerations

The “in re estate of prestie” cases highlight the importance of careful estate planning to avoid or mitigate potential issues. These cases can have a significant impact on the distribution of assets, tax implications, and the overall administration of an estate.

Strategies to Avoid or Mitigate Potential Issues

To avoid or mitigate potential issues, individuals should consider the following strategies:

- Create a comprehensive will that clearly Artikels your wishes for the distribution of your assets.

- Establish a trust to manage your assets and protect them from creditors and other claims.

- Consider gifting assets to loved ones during your lifetime to reduce the value of your estate and minimize estate taxes.

- Appoint a trusted executor or personal representative to administer your estate according to your wishes.

Recommendations for Individuals Affected by “In Re Estate of Prestie” Cases

If you are affected by an “in re estate of prestie” case, it is crucial to seek legal advice immediately. An experienced estate planning attorney can help you understand your rights and options and guide you through the probate process.Additionally,

consider the following recommendations:

- Review your will and other estate planning documents to ensure they are up to date and reflect your current wishes.

- Contact the executor or personal representative of the estate to discuss your concerns and request information about the distribution of assets.

- Consider mediation or other forms of alternative dispute resolution to resolve any conflicts or disagreements within the estate.

By taking these steps, individuals can protect their interests and ensure that their wishes are respected after their passing.

Questions and Answers

What is the legal definition of “In Re Estate of Prestie”?

In Re Estate of Prestie refers to a legal proceeding in which a court oversees the administration and distribution of an estate when the deceased individual died without a valid will.

What are the key steps involved in the probate process for “In Re Estate of Prestie”?

The probate process typically involves appointing an executor or administrator, identifying and valuing assets, paying debts and taxes, and distributing the remaining assets to beneficiaries.

How are assets distributed in “In Re Estate of Prestie” cases?

In the absence of a will, state laws determine how assets are distributed, often prioritizing surviving spouses, children, and other close relatives.